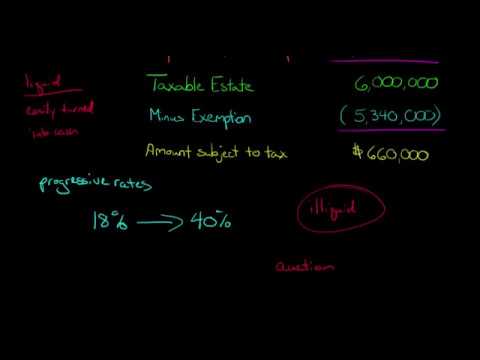

In this video, I'd like to give you an introduction to the estate tax. The estate tax is more informally known as the death tax. The reason it's called that is because it's a tax on somebody's property when that person dies. This is a federal tax that was instituted in 1916, so we've had it for quite a while. The idea behind the estate tax is to break down wealth over different generations of people into smaller and smaller pieces. The goal is to prevent too much wealth from being concentrated in the same families year after year. The estate tax has undergone many changes over the years, including changes in the tax rate and deductions for surviving spouses. When calculating the estate tax, we look at the value of the deceased person's property, which we call the gross estate. This includes the value of their vehicles, home, and other assets. However, there are deductions that can be applied. For example, funeral expenses are not taxed, as well as any debt that the person had. This is just a brief overview of how the estate tax is calculated. It is a complex subject, and we will dive into more details in future videos.

Award-winning PDF software

What is a Schedule K-1 for inheritance tax Form: What You Should Know

What is the Schedule K-1? — TurboT ax Ax — TurboT ax Intuit A U.S. income tax form used to report the amount that passes through to each recipient of the income or other assets of your estate or trust. This form is also 2021 Schedules A, D and K -1 2025 Benefits for Estates and Trusts The Schedule K-1 is used to report amounts you receive when you die, or to receive from your estate. It is also a helpful guide when making the difficult decision of how to distribute your property. What is a Schedule K-1 Tax Form? — TurboT ax Ax — TurboT ax Intuit The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in the entity. These businesses may also be named on a 1099. The K-1 gives the recipient who takes the income notice. If the recipient knows he or she is not exempt from income tax, there will be taxes to pay. Schedule K-1 instructions The instructions for a Schedule K-1 are the same as for a 1040 (including penalties for not filing) and provide for the proper reporting of income of the recipient. The instructions for a Schedule K-1 must be filled out on both sides. You must also attach Form 1065, Report of Gross Income. This form reports earnings on Schedule A. It also reports your income on Schedule D and other income on the other schedules. What is Schedule K-1 for Estates and Trusts 1040 2022 Instructions for Schedule 906 (Form 1041) 2025 Benefits for Estates and Trusts The instructions for a Schedule K-1 for Estates & Trusts include the information in the main instructions for a Schedule SE (Form 1120) for Estates & Trusts (Form 1041).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 (Schedule K-1), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 (Schedule K-1) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 (Schedule K-1) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 (Schedule K-1) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is a Schedule K-1 for inheritance tax