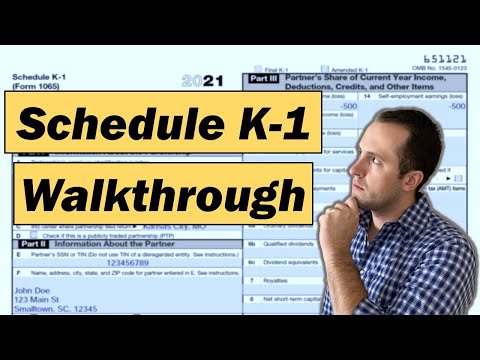

Hey everyone, I'm Bradford with the Pennsylvania Personal Finance. First, make sure to hit that like button so we know to make more videos like it. In this video, I'm going to be walking you through how to fill out the IRS forms Schedule K-1, which is part of your 1065 partnership informational tax return. You're required to file each year. Now, for the K1, you're required to file as well as issue one for each member of the partnership. So let's jump into this form and walk you through from start to finish. Alright, so here we have the Schedule K1, which is in addition to your 1065. So, going through from top to bottom, you're only going to select "Final K1" if you were closing out your business and this is the last one that is being issued to the members of your partnership. "Amending K1" is obviously if something changes and you're trying to change it and refile your forms. Put the beginning of the tax year and the end of the tax year for this example. Continuing with our YouTube side hustle business, it is the entire tax year of January 1st, 2021, through December 31st, 2021. Continuing down here, you're going to put your Employer Identification Number (EIN), so you can just copy and paste that from your 1065. You're going to put the partnership's name, address, city, and zip code. Where is the IRS center where this partnership return is going to be filed? So, if you look in the 1065 instructional form, it's going to show you where you need to file your partnership tax return depending on the state you live in, as well as depending on what kind of revenue you're generating. So, for this example, it's going to go to Kansas City,...

Award-winning PDF software

Video instructions and help with filling out and completing Form 1065 (Schedule K-1) vs. Form 1065-b Schedule K-1